The *capital one venture card* is one of our favorite credit cards for beginners thanks to its low annual fee and how easy it is to both earn and redeem miles for travel.

And unlike some starter cards, this one comes with a big sign-up bonus: You can earn 75,000 Capital One miles after spending $4,000 in the first three months of card membership, plus get a one-time $250 Capital One Travel credit.

That's up from the standard 75,000-mile bonus (without travel credit) and makes it one of the best offers we've ever seen. If you're in the market for your first travel card, you'll be hard-pressed to find a better bonus than this current limited-time offer.

With the Venture Rewards card, you'll earn 2x miles on every purchase. So by spending the required $4,000 in the first three months of card membership, you'll wind up with a minimum of 83,000 Capital One miles when all is said and done.

Since Capital One miles can easily be used to cover travel purchases at one cent each, all those miles plus the one-time travel credit add up to more than $1,000 worth of travel. Not bad for a card with a $95 annual fee, right?

But the benefits go beyond a big upfront bonus. You'll earn a flat 2x miles for every dollar you spend, making this a solid card for racking up miles on your everyday spending. You'll also get a credit to cover the cost of signing up for either Global Entry or TSA PreCheck, and two free passes to Capital One lounges … at least for the remainder of this year.

Read on for everything you need to know about the Venture Rewards card's benefits and big bonus offer.

Learn more about the *capital one venture card*

Capital One Venture Card: Overview

- Welcome Bonus: bonus_miles_full

- Earn unlimited 2x miles on every purchase

- Earn 5x miles on hotels and rental cars booked through Capital One Travel

- Up to a $100 credit for Global Entry or TSA PreCheck

- Two free annual passes to visit the new Capital One Lounges (Capital One Lounge access is going away effective Dec. 31, 2024)

- Fly on any airline or stay in any hotel, with no blackout dates

- Capital One miles don't expire for as long as you have the card

- No foreign transaction fees

- $95 Annual Fee

Capital One Venture Card: Full Benefits Breakdown

Venture Rewards Card Sign-Up Bonus

The Capital One Venture Rewards Credit Card is currently offering a bonus of 75,000 Capital One miles after spending $4,000 in the first three months of card membership. Plus, you'll get a one-time $250 Capital One Travel credit to be used in your first year.

Add it all up and you've got at least $1,000 worth of travel from the sign-up bonus alone. This is one of the best offers we've ever seen on the Venture Rewards card, making it worth the attention of every traveler … not just beginners.

Read more: Venture or Venture X: Which Card is Best for You?

Earning Miles With the Venture Rewards Card

One of the best perks of the Venture card is how easy it is to rack up miles.

You will earn 2x Capital One miles on all spending, with no limit on how much you can earn each year. That makes the Venture card a great card for your everyday expenses. Keep in mind, that each mile can be redeemed for a minimum of 1 cent toward the cost of travel. That's an unbeatable return, as most credit cards offer just 1x points on everyday spending.

Capital One Venture cardholders will also earn 5x miles per dollar spent on hotels and rental cars, booked via the Capital One Travel Portal.

Venture Rewards Card Annual Fee

The Capital One Venture Card carries an annual fee of $95 which is not waived for your first year of card membership. But when you compare the welcome offer to its more premium (and costlier) alternative – the *venture x* – offering the same welcome offer bonus, it's a great deal.

The Venture Card also does not charge foreign transaction fees.

$250 Capital One Travel Credit

The sweetener with this limited-time offer is the one-time $250 Capital One Travel credit … but what's it good for? And how do you use it?

For starters, new cardmembers will get this credit right away. Unlike the big point bonus, this travel credit does not require you to meet a minimum spending requirement in order to earn it. That's pretty much unheard of in the world of credit card sign-up bonuses.

The next thing to note is that the credit is only valid for one year and expires on your account open date's first anniversary. But that doesn't mean that you'll need to complete your travel by that date.

So long as you use it to book a flight, hotel, or rental car before it expires, you can actually travel well beyond that date. Just be warned: If your plans change and you have to cancel after the expiration date, you won't get that credit back. If you need to make any changes while the credit is still valid, it will be restored and you can use it for something else.

Unlike the annual $300 Capital One Travel credit that comes with the Capital One Venture X card, this is a one-time $250 travel credit you can only get as part of this limited-time welcome offer on the Venture Card. You won't get another one each year.

Now that we've got some of the finer details out of the way, let's discuss how to actually use the credit and more importantly, what type of travel you should try to use it on.

For those unfamiliar, Capital One Travel works very similarly to other online travel agencies (OTAs) like Expedia and Priceline. You can book flights with most airlines, as well as chain and boutique hotels, rental cars, and even vacation rentals all through Capital One Travel.

To use your new credit, simply log in to your Capital One account online and click the “travel” button under “rewards.”

Once you find something that you want to book, the credit will automatically be applied at checkout. You can use it up across multiple purchases or all at once. Unfortunately, since the credit is applied as a discount on the purchase price and not a statement credit, you won't earn any extra rewards on that $250 credit. That's a small bummer but not the end of the world as you're still getting $250 worth of travel for free.

Just know that pricing across all the different travel portals will vary wildly. Earlier this year, we ran hundreds of searches comparing Capital One Travel to competitors like Chase Travel℠ and and Hopper (which actually powers the Capital One Travel portal) as well as booking directly with a hotel, airline, or rental car agency. What we found was that these pricing discrepancies are most prevalent with hotel bookings, while flights and rental cars were most consistent.

The lesson learned is that no matter if you're booking with Capital One Travel, Expedia, or direct, it's important to do a little price shopping to ensure you're getting a good deal.

Statement Credit for Global Entry or TSA PreCheck

If you apply for either Global Entry or TSA PreCheck and pay with your Venture card, the full application cost will be reimbursed (for now). You can use this benefit once every four years, and membership in both programs lasts a full five years.

The cost of Global Entry is set to increase to $120 effective Oct. 1, 2024. While other banks like Chase and Citi have committed to increasing the credit that comes with their top travel cards to cover the full, higher cost of Global Entry, Capital One hasn't yet announced any changes. Right now, the Venture Rewards card's Global Entry/TSA PreCheck credit covers application fees up to $100 – but this will hopefully change when the new fee goes into effect in October.

Since Global Entry includes TSA PreCheck, it should be your choice if you travel internationally. Check out our guide for more info on how to sign up for the program from start to finish.

Already have Global Entry or TSA PreCheck? You can use this credit to cover the application for a friend or family member! Just pay for their application with your Venture card and you're set!

Two Free Capital One Lounge Visits Each Year

Venture cardholders get two free annual passes to visit the new Capital One Lounges … but only for a little longer.

Effective Dec. 31, 2024, these annual passes will be going away entirely. But for now, it's a nice perk of having the card, and picking it up now means you've still got nearly half a year to put these passes to use.

Capital One opened its first airport lounge in Dallas-Fort Worth (DFW) and followed it up with two more in Denver (DEN) and Washington D.C.-Dulles (IAD) last fall. Other lounges are in the works (but a ways off) in Las Vegas (LAS) and New York (JFK), while Capital One plans to open special dining spaces called Capital One Landings in both New York City-LaGuardia (LGA) as well as Washington, D.C.-Reagan (DCA).

But unlike Capital One Venture X cardholders, these annual passes don't allow free guest access. That’ll cost an extra $45 each. One exception: Capital One has confirmed that Venture cardholders can use one of two free annual lounge passes for a guest.

Once cardholders have used up those free passes, they can still get a discounted entry rate of $45 per visit (the standard entry fee is $65 per visit). And even after you’ve used up your free passes, you can still bring a guest in with you at the same $45 rate.

Redeeming Capital One Miles

Capital One flipped the travel world on its head by transforming Capital One miles into an indispensable travel rewards program for travelers who want to do more for less.

No other credit card points give you more flexibility and versatility to redeem miles toward travel. That includes flights, hotels, rental cars, and much more. Whether you’re just getting started with earning and redeeming miles and want a simple option, or consider yourself an advanced traveler who knows how to maximize your points and miles, there’s a path for you with Capital One miles.

Here are a few of the best ways to redeem the miles earned with a Venture card.

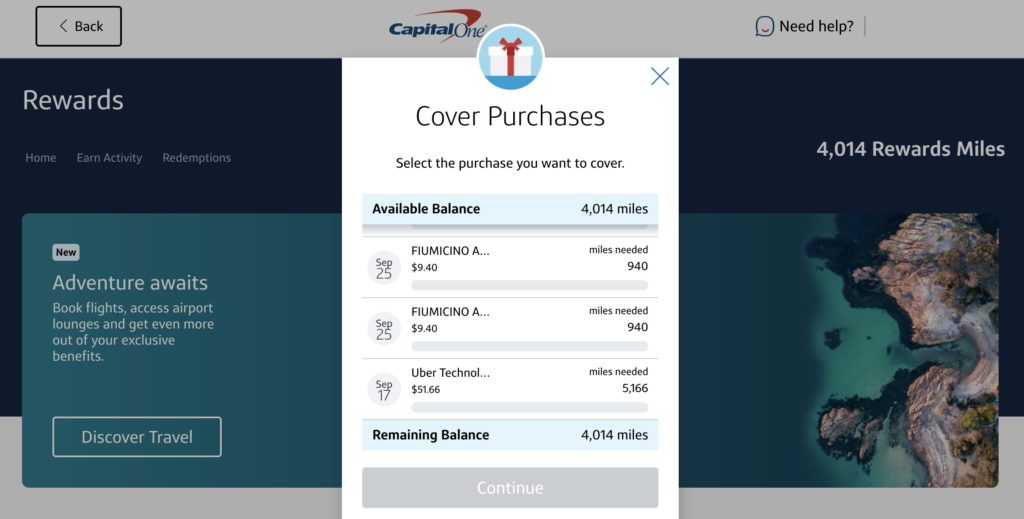

Cover Travel Purchases

Let’s start with the easiest route. This is what Capital One is really known for.

No airline or credit card company makes it easier to redeem points and miles toward travel. Just charge your flight, hotel, Airbnb, bucket-list golf trip, or almost any other travel expense to your Capital One card. A few days later, you can log in and remove that charge from your statement using miles.

Read our step-by-step guide to covering travel purhcases with Capital One miles to see how it’s done!

Using Capital One miles this way, every mile is worth 1 cent. That means you can book a $500 flight using 50,000 Capital One miles. That may not be earth-shattering value, but it’s easy as can be – and pairing it with a cheap flight deal can take you quite far, literally.

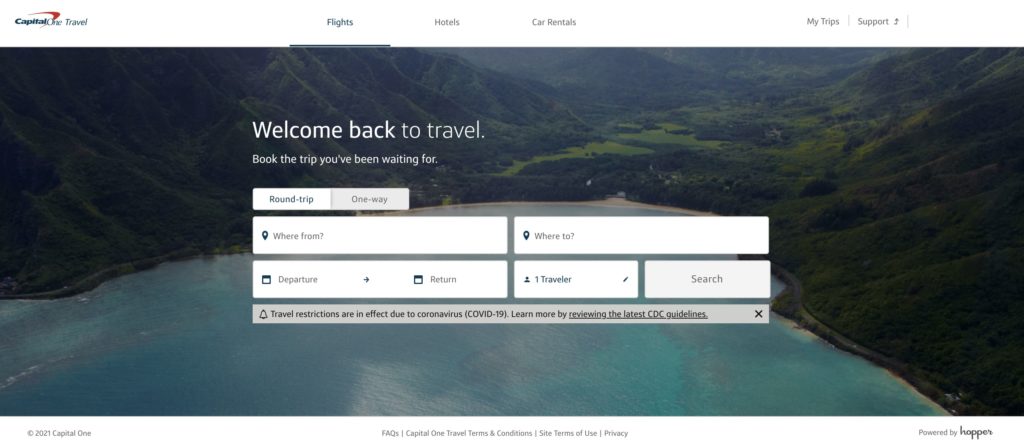

Book Through the Capital One Portal

Just like the Chase Travel Portal, Capital One has its own travel portal where you can search directly for flights, hotels, car rentals, and more, then book using points. And the Capital One Travel Portal is new and improved, with some great features you won’t get elsewhere.

The new travel-booking engine is powered by the popular app Hopper. That means you should generally (but not always) find the same prices you see directly through the airline or via Google Flights. Just tap in the details of the flight you’re hoping to book with Capital One miles and start searching.

While flights booked through the Capital One Travel portal are pretty consistent with what you'll find booking direct or when using a different travel search engine, the same isn't true for hotels. After hearing from several readers that hotels booked through Capital One Travel were more expensive than other options, we dug into it. After searching hundreds of hotels, our team discovered that in many (but not all) cases, Capital One travel was the most expensive booking option.

That's not to say the Capital One Travel portal is worthless, or a bad option, it's just important to price shop before blindly using your miles to book through Capital One.

Additionally, you won’t get a bonus when using miles through the Capital One Travel portal as you do with Chase cards like the *chase sapphire preferred* or the *chase sapphire reserve*. Just like booking straight through the airlines or hotels, each Capital One mile is worth 1 cent toward travel through the portal.

Since the Capital One Venture card earns bonus miles on hotels and rental cars booked through the portal, you really shouldn't be redeeming miles like this at all. Instead, you'd be better off using your card to pay for flights and other travel booked through the portal and then using your miles to cover the purchase later on.

All that being said, there are a few reasons why using Capital One miles through the travel portal can make good sense:

- Capital One will automatically refund you if the price of your flight drops after booking. Those Price Drop Protection refunds are only available on flights where Capital One and Hopper predict that prices won’t fall, and they’re capped on up to $50 – or 5,000 Capital One miles – in refunds total. Still, that’s a nice feature.

- You can freeze a fare through the portal for up to 14 days, then decide and come back to buy it later at that price. Capital One charges a small fee to freeze a fare.

- Much like Google Flights, Capital One allows you to set price alerts for the flights you want to book. That means you’ll get an email if the flights you’re looking at drop or increase in price.

- Capital One offers an add-on “cancel for any reason” travel insurance policy, which is quite reasonably priced.

Unfortunately, the travel portal took a hit earlier this year when Capital One capped price drop refunds at $50. And now, the portal's Price Match Guarantee gets paid out in travel credits.

Level Up Using Capital One Transfer Partners

For years, the beauty of Capital One Miles has been their simplicity. Charge a flight to your Capital One card, then go back and cover the cost using miles.

But if you want the most value from your Capital One miles, you’ll want to look into Capital One transfer partners.

Capital One added the ability to transfer miles straight to airline programs back in late 2018. After steadily adding more and more partners and making significant improvements, it’s now a bonafide option with some killer value. With few exceptions, every 1,000 Capital One miles you transfer gets you 1,000 airline miles or hotel points.

Here’s the full list.

| Program | Type | Ratio | Transfer Time |

|---|---|---|---|

| Aeromexico | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| Avianca LifeMiles | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific AsiaMiles | Airline | 1:1 | Up to five business days |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Up to 1 day |

| EVA Air | Airline | 2:1.5 | Up to five business days |

| Finnair | Airline | 1:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| TAP Air Portugal | Airline | 1:1 | Same day |

| Turkish Airlines | Airline | 1:1 | Same day |

| Virgin Red | Other | 1:1 | Same day |

| Accor | Hotel | 2:1 | Up to two business days |

| Wyndham | Hotel | 1:1 | Same day |

| Choice Hotels | Hotel | 1:1 | Same day |

Read more: Save Points When Booking Flights: Transfer Them to an Airline Partner

Bottom Line

The *capital one venture card* has long been one of the best travel rewards credit cards for beginners because of how easy it is to earn and redeem miles. To go along with it, the card's sign-up bonus offer of 75,000 Capital One miles, plus a one-time $250 Capital One Travel credit is pretty tough to beat – assuming you can easily spend $4,000 in the first three months.

Learn more about the *capital one venture card*